Debt Consolidation vs. Debt Settlement: Which is Better to Get Out of Debt?

If you’ve found yourself in a significant amount of debt, clearing this financial hurdle is an important priority. Debt consolidation and debt settlement are both options for resolving debt, but that’s largely where the comparison ends. These methods employ very different tactics, and have much different ramifications for your credit score and the timeline before you are free of debt.

What Is Debt Consolidation?

Debt consolidation is a debt management strategy in which you combine multiple debts into a single payment. The basic idea is that consumers can save money and time by transferring debt to a lender with lower interest, and that it’s simpler to deal with one lender than balance multiple debts to different lenders. So how does debt consolidation work? Here’s an example:

If you owe one creditor $50 per month at 18.99% interest, another creditor $50 per month at 9% interest, and a third $50 per month at 24.99% interest, you could take out a consolidation loan and settle all three debts. Then, you’d owe the new lender $150 per month under a single interest rate. If you’re strategic about consolidation methods, you might even be able to get a decreased interest rate. Average debt consolidation loan interest rates are around 18.56%, comparable to some credit cards, but a strong credit score and short loan term could help your chances of getting a rate as low as 4.52% to 7.37%.

What’s the smartest way to consolidate debt?

The two main ways to do this are to use a 0% interest, balance transfer credit card, or to take out a debt consolidation loan. The credit card option is often only available for people with a credit score around 680 or higher, and the 0% interest rate is usually in effect for a 12-18 month promotional period. It may also incur a one-time balance transfer fee. Typical debt consolidation loans typically come with interest rates that can easily be as high as a credit card, but they may be more widely available for people with lower credit scores.

The main advantage of debt consolidation is that it’s easier to pay monthly debts to a single lender, and you may be able to secure a lower overall interest rate on your debt. Important drawbacks are that if you extend the repayment period to lower monthly payments, you could pay more in total by adding interest. Debt consolidation loans may also use assets like your home or car as collateral.

What Is Debt Settlement?

Debt settlement is a process where you offer the lender a lump payment up front — often less than the total amount you owe — in order to remove your debt. It seems strange to imagine that a lender would happily agree to accept less than what you owe, until you take into account that 10% of Americans expect to take 10 years to pay back credit card debt, and others don’t ever expect to repay the balance. Some lenders would rather get what they can immediately than hold out hope of receiving the full balance in a decade or more.

That said, lenders don’t have to work with you on a settlement. It can take months or even years of negotiation to convince them to work out an arrangement. It’s also extremely important to get all the details in writing, including an official statement that the debt is considered satisfied. The last thing you want is to scrape together a lump sum settlement and then have the lender come after you for the remainder anyway.

The main advantage to debt settlement is that it gets rid of a debt altogether. The downside is that the process can be lengthy, complicated, and stressful. Debt settlement can also negatively impact your credit score. Settlement is a better option than bankruptcy in most cases, but it’s better to stay current on debt payments than “save” money with a settlement.

Which is Better Debt Consolidation or Debt Settlement?

The right debt relief strategy for you depends on your circumstances. It’s always important to research your options carefully before entering into a new financial agreement.

That said, debt consolidation has some important advantages over debt settlement, especially in terms of your credit. Debt consolidation can lead to a dip in credit because loans or a balance transfer credit card application require a hard inquiry on your credit. This should only be a temporary dip of a small number of points. Depending on how well you commit to paying your debt consolidation loan payments on time, you could see your score improve or worsen. You’ll have a longer period of time before you’re debt free, but if you play your cards right, you can be on good financial footing by the time you send your last payment.

Debt settlement, in comparison, is only available once your account is delinquent. A creditor isn’t going to be open to lowering the amount they accept if they’re receiving regular payments. Missed payments will hurt your credit. Then once you’ve missed enough payments to open negotiation, you’ll miss more during the lengthy process of agreeing on a settlement. The settlement itself will also reflect negatively on your credit report, showing up as a zero balance, but with a note that the account was settled for less than the amount owed. All this remains on your credit report for seven years, which can seriously impact your ability to apply for business loans, a new mortgage, or other major financial agreements.

Families who are already delinquent on loans and struggling to get their head above water may turn to debt settlement as a last measure. But if your debts are current or even only one or two missed payments behind, you may find that debt consolidation is much better for your financial health in the long run. You may be wondering, what are alternatives to debt consolidation?

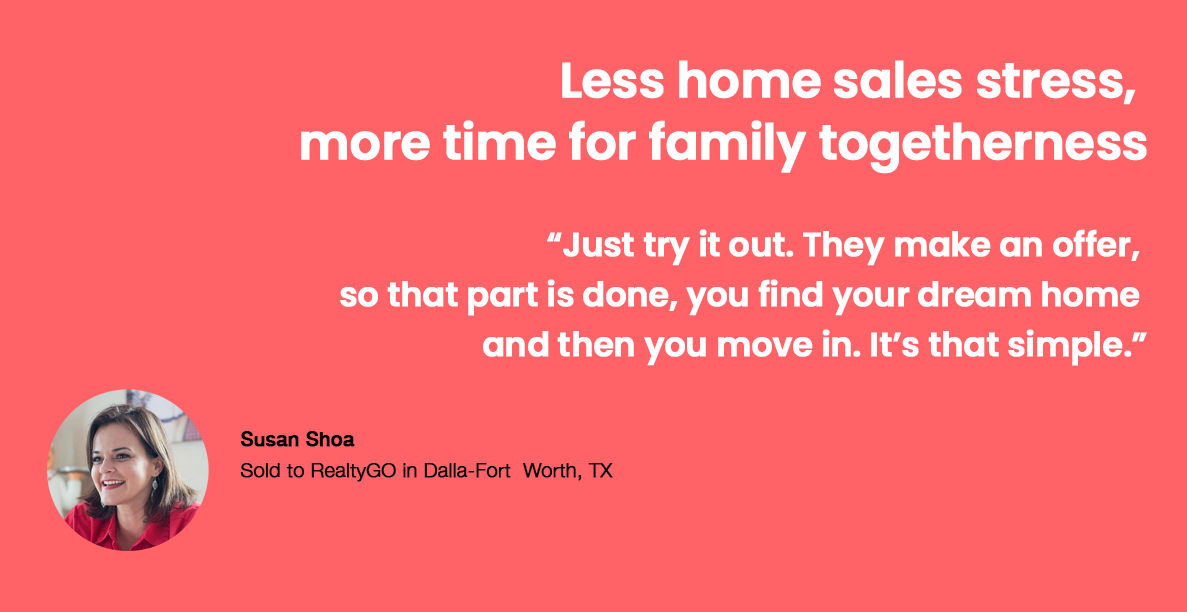

How RealtyGO Can Help

At RealtyGO, we’ve seen that a house can be much more than a roof and four walls. It’s also a major source of many family’s wealth, often your most valuable asset. We believe using your home equity wisely can be part of a healthy approach to family finance – which is why our mission is to help homeowners unlock the wealth in their homes.

Getting out of debt can feel like an almost insurmountable hurdle, especially because some options like debt consolidation replace debt with…well, other debt. Some homeowners are relieved to hear about RealtyGO’s Home Value Investment which helps homeowners access funds they need without adding debt to their official financial profile. RealtyGO’s Home Value Investment is not a loan. There’s no interest and no monthly payments to factor into your budget. You can use part of the equity you’ve grown in your home to pay off debt in a way that fits best for your long-term financial health. That may help explain why, of all the funding RealtyGO has provided to homeowners since 2016, 33% of those funds have gone directly to pay off debt. Find out if RealtyGO is available in your area and how much you qualify for, without impacting your credit score.

Tackling debt can be an important financial and personal goal. You feel better when you’re not worrying about how to pay multiple creditors. The method you choose to pay off debt can have a big impact on your financial life afterward. Research your options carefully, and choose the debt relief method that’s most sustainable and healthy for your family.

How to Cover Large Medical Bills

Roughly 28 million people in the United States do not have health insurance. A hospital stay can cost nearly $4,000 per day, and life-saving surgeries or cancer treatments can come with six-figure price tags. Even people with insurance can find themselves on the hook for bills for many thousands of dollars.

Regardless how much money you have saved, an unexpected medical expense can leave you in trouble. If you get behind on other bills while dealing with a medical expense for you or a loved one, you can end up in a cycle of debt that’s hard to escape. So how can you get help with medical bills to avoid going deep into the red?

Get the Bill as Low as Possible

There isn’t a single, overarching structure in place to guide healthcare and hospital billing. That means hospitals may have to work on their own to balance their need to stay financially afloat with the need to comply with complex government regulations and billing requirements, and serve people in their community.

Medical providers may be willing to work with you to figure out a payment plan. Your first step is doing what you can to lower your bill.

Before going to the hospital

In an emergency, you may not have time to research options and discuss a detailed plan for your care. But if you have time to plan out your medical care, keep these ideas in mind:

# Choose in-network providers: Talk with your doctor about everyone who will be on your healthcare team so you don’t overlook a care provider (e.g., the anesthesiologist for someone who is giving birth).

# Ask for an estimate: Before you schedule an appointment or procedure, you can request an estimated cost for the services. You can also confirm they accept your insurance.

# Compare providers: Different hospitals or clinics may price services differently. Comparing options may help you find the most affordable care. Of course, quality of care comes first — consider success rates for your procedure and your own comfort level with the provider, as well as any financial considerations.

# Ask about your care plan: Many doctors let their office deal with charges and focus on treatment first (understandably). They may not realize you’re struggling to afford a certain test. You can ask if there are other tests or treatments available that achieve similar results at a lower cost.

After leaving the hospital

Once you have a bill in hand, it may feel like it’s too late to do anything about it. Not true: In many cases, you may be able to reduce the amount you owe even after you’ve received your care and been billed. Here’s what to do:

# Request an itemized bill: Hospitals are required to provide you with an itemized bill upon request. Often, requesting is enough to knock some money off the total. Why? An administrator preparing the bill may notice and correct errors along the way or cut miscellaneous charges.

# Review the bill for errors: As many as 80% of hospital bills contain errors, according to some reports. You can contest any charge you feel is inaccurate for the care you received.

# Work with a patient advocate: A patient advocate can offer medical bill assistance to decipher jargon and help catch possible errors you might overlook.

# Ask about discounts and payment plan options: The billing office can talk with you about any solutions to make smaller payments over time, or even discount charges if possible.

These tips may help decrease your bill, but they likely won’t remove it altogether. The next step, once you have your reduced medical bill balance, is figuring out where to find additional help with hospital bills.

Finding Financial Assistance for Medical Bills

When unexpected bills hit, many people search for loans to pay off the debt. The problem is that this strategy still leaves you in a tough position if you are unable to pay back the loan soon. What’s more, some loans use your home as collateral, meaning too many missed payments could lead to foreclosure.

What happens if my medical bill goes to collections?

Ignoring a medical bill won’t make it go away. A medical provider can send the debt to collections. Legally, debt collectors are not allowed to harass you, lie, or conduct unfair practices. In reality, debt collectors are notorious for breaking rules and using underhanded tactics to get payments.

The three major credit bureaus wait 180 days before including medical debt on your credit report. Some credit score calculation models will ignore paid collection accounts, as well. If you’re able to pay debt or agree to a payment plan to keep your medical debt out of collections, you may be able to avoid hurting your credit score. However, if a medical debt goes on too long unpaid, it can impact your credit and remain on your report for 7 years.

Get help paying medical bills

Instead of rushing to replace medical debt with another loan, take time to understand your options and reach out for financial assistance.

# Medicaid and CHIP help pay medical costs for children in families who can’t afford health insurance.

# Social Security Administration (SSA) offices and Medicare may be able to help people over 65, people with disabilities, and people with end-stage kidney disease.

# Cancer patients and others with chronic illnesses may have trouble making ends meet financially. A support organization related to your condition (e.g., the American Cancer Society) may offer resources for patients and families to find financial assistance for medical bills and other critical expenses.

# State government programs: California, New Jersey, New York, Rhode Island, and Washington state offer paid leave benefits for caregivers.

For general guidance on debt, you can speak with a nonprofit credit counselor to see if there are ways to consolidate or lower your total debts to a more manageable balance.

Are loans a good way to pay off medical debt?

If you decide a loan is your best option to pay off medical debt, remember that not all funding is equal. Choosing a reputable financier and repayment terms that you’re confident you can meet is essential.

Repayment terms can feel like the hardest challenge to overcome. Medical expenses are typically interest free, so paying them off with an interest-bearing loan (like a credit card) can feel like a step backward. If making monthly payments to the hospital strains your finances, it can also feel like making monthly payments to another lender will be no better.

For some families, a Home Value Investment with RealtyGO could be a viable solution to get help with medical bills. The RealtyGO investment gives homeowners a lump sum of money immediately. There are no monthly payments or interest. Instead, the eventual repayment is based on how your home value has changed over time. For homeowners who already planned to move in the coming years (e.g., to downsize), this can be an easy way to use home equity toward a current need, instead of waiting for years to access that value.

A medical emergency can affect anyone, and no one should have to face the prospect of ruinous debt to access needed medical care. If you’re struggling to find help paying medical bills, talk to an experienced financial professional about where to access financial aid resources to pay your debt and protect your credit.

What to do when COVID-19 Affects Your Child’s College Plans

Many parents and students believe hefty tuition fees should purchase a particular college experience — such as in-person classes, mentorship, and access to labs or other resources. When classes moved online in the spring due to COVID-19, some students sued to try to recoup the value they felt they lost.

The sticky truth is that many college expenses are a financial casualty of the coronavirus pandemic. It’s often difficult to redistribute money you’d earmarked for education or get much money back once you’ve paid for your student.

Why Won’t the University Refund My Tuition?

There are multiple reasons that a student may end up withdrawing from a semester of college, such as struggling with virtual learning, or having to leave campus after breaking social distancing rules.

Unfortunately, getting a refund on tuition is difficult. The challenge is that colleges can’t generally swap out students mid-semester, and a student can’t “return” information they learned in the first weeks or month of classes. If colleges feel that they can still offer equivalent coursework online, they’re also unlikely to agree to a refund. You may have an easier time getting money back for room and board or other fees, although some colleges have announced they will not offer prorated refunds if the campus must close in the fall 2020 semester. Some schools may refund partial tuition on a sliding scale, but unless you withdraw in the first week or two of the semester, you can expect to be on the hook for the majority of the costs.

Even contracting COVID-19 is unlikely to result in a refund. Only 6% of colleges and universities offer 100% tuition refunds for medical withdrawals. If students are dismissed for a disciplinary reason, such as breaking social distancing rules, it’s extremely difficult to make a case for a refund.

How to Mitigate Tuition Losses

The 2020-2021 academic year may be unlike any other for colleges and universities. While most colleges seem firmly against tuition refunds, a lot is up in the air right now as universities and students draw their own lines in the sand. In other words, you may have more chances to reclaim lost college costs, depending how hard you’re willing to fight.

Students at several colleges, including Rutgers and Texas A&M, have banded together to demand reduced tuition, reflecting the loss of access to campus services they say their payments would normally cover. A student petition at Brown University resulted in the university reducing or cancelling several fees. Connecting with as many other students as possible (or even asking alumni to add their voices) may be your best chance at convincing your university to consider lowering or waiving certain costs.

Another possible option to consider is tuition insurance. A third-party provider may insure your student if they need to withdraw from classes because they (or you) become ill, including COVID-19 illness. Tuition insurance may not cover disciplinary removal, such as the students dismissed from Northeastern University for breaking social distancing requirements. Even if you feel that social distancing rules are not feasible for students to follow, if they agree to the rules in their code of conduct, you may be out of luck as far as getting tuition back.

Finally, have a backup plan in place. When campuses closed in the spring 2020 semester, many students had little time to pack, make travel arrangements, and finalize a place to stay. Some students didn’t have a safe living option besides campus housing. If your student is on campus, do you have a way to get them home on short notice that is safe and affordable? Do you know how you’d deal with collecting their possessions? If you are fortunate to have extra living space, such as a guest home, you might even be in a position to help a student without another place to go.

Can I Still Use 529 Funds for Virtual College?

The pandemic may have changed many plans, or even prompted young adults to reconsider their best option. Fortunately, you have quite a few options for using 529 funds to cover your child’s next steps.

Even if your child decides against pursuing a 4-year degree, 529 funds can go toward many vocational schools, technical schools, or apprenticeships, as well.

You can use 529 funds toward necessary equipment for your student to participate in classes. Computers, software, and even Internet access may be qualified expenses. Check with a qualified financial professional about expenses you’re not sure of, such as a noise-canceling headset, or how to offset a student’s share of Internet access on a shared family plan.

If you need to take a non-qualified withdrawal from your student’s 529 plan, you’ll pay taxes on investment gains, along with a 10% penalty in most cases.

Unfortunately, you can’t dip into the 529 to cover living expenses. You can pay for a college’s room and board plan with 529 savings, but if your student is living at home, you can’t offset grocery or mortgage bills out of the 529 account. That’s one reason why it may be helpful to use 529 funds toward as many qualified expenses as possible, such as books, course fees, and computers, since you may have a higher household budget than you’d planned for.

When Will College Go Back to Normal?

There’s no saying for certain what coming months will bring, but some experts worry that COVID-19 will continue to be a major threat this winter. Illnesses can make their way through a campus any year, and it seems possible that some campuses will face hard choices again about whether to stay open or close for student and staff safety.

One possible silver lining is that the need for widespread virtual college classes may drive colleges and universities to innovate. Implementing more responsive technology to accommodate students and professors may be part of a “new normal” that expands the ways people can access a college education.

In the meantime, preparing a safe, quiet study space — and fast Internet — may be a major part of supporting your college student to get the best possible education they can right now. Whatever the future brings, planning financial and logistical support for college students in your family can play a big role in their success.

Why Does Debt Feel Like It Defines Us?

People of all ages and stages of life experience debt. So if most people have it, why does debt feel so personal, and why is it so hard to admit it when we’re struggling?

Debt isn’t just a problem with money in your wallet or bank account. The stress of debt can manifest in your mood and even your body. Debt can also stand between you and important milestones for your family. Managing your finances to keep debt under control can be good for your wellbeing in several ways, so let’s dig into our relationship with debt.

What Does It Mean to Have Debt?

At its most basic, debt happens when you owe something valuable (usually money, but not always) to someone else. Asking a friend to spot you $20 for lunch or applying for a $200,000 mortgage loan from a bank are both ways to take on debt.

The difference (other than the number of zeroes) is that your friend will only ask for the $20 back, whereas the bank will add a considerable amount of interest over time to the principal amount that you borrowed. If you take out a $160,000, 30-year mortgage to buy a $200,000 home, and interest is set at 3.78%, you could end up paying over $107,000 in interest by the time you repay the entire loan. That’s two-thirds of the amount you initially borrowed!

Americans aged 35-64 carry an average debt balance over $100,000. When you consider how much interest can add to the starting amount you borrowed, it’s easy to understand how quickly people can feel in over their head.

How Does Being in Debt Affect You?

Part of the trouble with debt is that it has a tendency to pop up everywhere. From the bank to the doctor’s office, here’s how debt might affect different areas of your life.

Debt and health

Researchers have studied debt extensively. Studies show multiple connections between debt and physical and mental health. Money problems have consistently ranked as a top source of stress for Americans since 2007.

Anxiety, stress, sense of helplessness, and depression are all common reactions to debt. These negative emotions can affect your physical health, too. A range of medical issues such as heart disease, back problems, ulcers, weakened immune system, and more are strongly associated with anxiety. So if debt feels especially personal or sensitive, that can be because the stress and guilt you feel show up in your body, too.

Debt, finance, and opportunity

Debt can also feel like an ever-present monster because of the ways it affects your finances. As if the mental and physical connections weren’t enough, debt impacts your opportunities.

On a daily or monthly level, debt can mean a stack of bills. You may not be able to afford some fun nights out or activities for kids because of how debt affects your family budget.

Lenders look at your debt-to-income ratio (DTI) to determine whether to offer you a loan. Carrying too much debt can affect when you can buy a home or borrow funds to start your dream business. Even if your income is high and you pay bills on time, debt can get in the way of the life you’ve imagined. DTI has generally been increasing over time, which is a sign that many families may be finding it harder to meet milestones or taking longer to get out of debt.

How much debt is healthy?

The reality is that 80% of us do live with debt, and probably will for a while. That doesn’t mean you’re doomed to suffer all the possible negative impacts. Careful debt management can help you keep debt (and stress) under control.

Ideally, you should aim to keep your total debt-to-income ratio (DTI) around 15-25%. A DTI under 20% is generally considered low enough to make you an excellent candidate for other loans or financing when you need them. The maximum DTI lenders will accept varies, but 40% is generally a sign that you’ve got about as much debt as you can comfortably handle. You can calculate your own DTI by checking what percentage of your monthly income goes toward paying debts.

Why Should You Avoid Debt?

As you can imagine, the more you can avoid debt, the more freedom you’ll have over your finances. You may see several advantages from getting out of debt or avoiding it in the first place:

# Lower monthly payments

# Possible option to retire earlier, since you won’t have outstanding loans to pay

# More flexibility to handle emergency expenses

# Less stress and worry

With that in mind, not all debt is equal. The “good debt vs. bad debt” rule says debts for something that increases your income or net worth over time (like student loans for education) can be worth it. Unsecured versus secured debt is also an important distinction to keep in mind. Secured debt lenders have the ability to seize assets (e.g., mortgage lender foreclosing on your home), whereas unsecured debt creditors may need to convert to secured debt before they can pursue this option.

Ultimately, before you take on any debt, it’s important to consider the benefits, risks, and terms carefully.

How Many Americans Are Debt Free?

Debt is the norm for most people. Mortgages, student loans, and credit card debt (which grew 285% from 1980-2010) make up a large portion of individual or household debt. In other cases, people go into debt to pay for major projects like home renovations. The struggle is balancing debt management against financing life-improving projects.

Even if debt is common, and often difficult to beat, that doesn’t mean it’s impossible. Around 20% of people across generations live debt free. If you’re starting to plan your path to being debt free, a debt relief service like a credit counseling program can help. Working with a financial advisor to assess your options is a smart first step to getting out of debt.

At RealtyGO, we’ve noticed that 70% of our homeowner partners use at least part of the funding they receive from us to pay off other debts, and 35% select debt payoff as their primary use of funds. That’s notable because it shows how important debt relief is for many families. Once you get debt to a healthy level, you may have more flexibility to tackle other financial plans.

RealtyGO Home Equity Sharing

As a reminder, home equity sharing is not actually a debt product. Your financing agreement is structured more like a partnership. RealtyGO doesn’t add interest to the financing you receive (remember, interest can add up to more than 50% of your initial principal over the course of a 30-year loan!). Plus, an agreement with RealtyGO won’t affect your DTI ratio, since you don’t have monthly payments.

Keeping monthly bills down can be one part of successful money management. If you and your financial advisor agree that tapping home equity is a worthwhile strategy, you’ll need to decide which payment terms make sense for you. On average, financing with RealtyGO saves homeowners $1,480 a month as compared to a HELOC or home equity loan for the same amount. Some homeowners find that it’s easier for them to save for repayment on their own schedule than commit to monthly payments, especially if you’re using your financing to pay off debt and improve your overall financial profile.

At the same time, even working with a home equity sharing company isn’t the same as feeling completely debt free. You’re still in a financial relationship where someone outside your family expects their share of funds by an agreed-upon deadline. This can still be stressful. Even if the financing doesn’t count as debt under DTI definitions, your personal feelings may be that you want to be totally financially unencumbered, as soon as possible.

Ultimately, the best way to relieve debt stress is to have a solid plan to get your finances in order. If financing with an agreement that doesn’t impact your DTI ratio benefits your health and stress, then home equity sharing may be a useful approach to consider.

Debt doesn’t define your value as a person, but it can impact your health, sense of wellbeing, and opportunities. In that sense, debt can be a defining issue to tackle so you can build your life on your terms.

What Gets Reported to Credit Agencies — and What Doesn’t

Managing your credit is an essential part of your overall financial health. Creditworthiness affects your ability to get a loan or participate in other financing agreements. You’ll make more confident plans for your future if you start with a solid understanding of what appears on your credit report, and what doesn’t.

What Is a Credit Score?

Most of us have at least a basic understanding of what a credit score is, but there’s no harm in a quick refresh. Simply put, a credit score is a 3-digit number, usually between 300 and 850, that represents your relationship with credit. The higher your score, the more creditworthy you appear to lenders.

There are a few different models for calculating credit scores. FICO is the most common credit score, used by around 90% of lenders. VantageScore is FICO’s main competitor, and credit bureaus may use their own scoring model as well. Equifax uses VantageScore and also calculates credit using its own 280-850 point scale. Other bureaus may use both FICO and VantageScore, or another combination of models. The most recent version of FICO breaks down like this:

# Payment history (35%): Your record of paying credit bills on time

# Credit utilization (30%): How much you currently owe credit lenders

# Credit history (15%): How long you’ve held credit accounts

# New credit (10%): How many new accounts or applications you have

# Types of credit (10%): Profile of what kinds of loans you have (mortgage, credit cards, etc.)

Your VantageScore uses the same categories, but credit utilization and types of credit you’ve held over time matter more than payment history.

Three credit bureaus collect information for your credit report: Equifax, Experian, and TransUnion. You’re entitled to check your full credit report, which lists detailed information about your credit habits, once per year. Part of the reason it’s worthwhile to request your credit report each year is to review for inaccuracies or fraudulent entries, and dispute them to protect your credit.

What Is a Good Credit Score?

When you apply for a loan or even a new job, the process might include a credit inquiry. Lenders set their own standards for what they consider excellent, good, and subprime credit. Typically, these guidelines are a good starting point:

Excellent: 800 or higher (some lenders offer their best rates for scores over 760, according to some experts)

Very good: 750 or higher

Good: 700-750 (you should consistently qualify for good rates at this level, but not the very best)

Fair/good: 650-700 (you’re slightly below national average here, but qualifying shouldn’t be a problem)

Fair: 600-650 (the best rates are out of reach, and qualifying may become an issue with stricter lenders)

Subprime: Below 600 (at this level, repairing credit should be a financial focus for you)

The credit you need to qualify for a mortgage depends in part on your area. Homeowners on the West Coast or the Northeast regions of the U.S. may need a 700 credit score to offer a competitive profile. People living in certain parts of the South can get by with a score around 670, or even lower.

Where Does the Information on a Credit Report Come From?

Some information on your credit report comes from public records, such as property records. Most of the information likely comes directly from the creditors. Banks, credit card providers, automobile financing businesses, and other creditors report information to the three credit bureaus.

What are the major areas on information included on your credit report?

Credit reports can vary between credit bureaus, but these are the categories of information a credit report includes:

# Personal information: Your full name, date of birth, address, SSN, and possibly employment history

# Credit history: Account opening date, credit limit or loan amount, monthly balance, and payment history

# Credit inquiries: Hard inquiries are credit checks from a financial institution to consider an application. They can result in a temporary dip in your credit score. Soft inquiries aren’t connected to an open application, so they don’t affect credit and may not appear on your report at all.

# Public records: Tax records, bankruptcy filings, property records, and other public records can affect your credit.

# Personal statement: Some credit reports offer the opportunity to provide a personal statement to provide context (usually for a negative entry on your report). If the coronavirus pandemic leads to a credit card delinquency, for example, that might be worth noting so future lenders understand what happened.

What do banks see when they do a credit check?

When a bank (or another potential lender) runs a credit check, they can view the above information. Banks and others checking your credit won’t see your income. They can see your credit history, but only on a monthly basis. That is, they can see what your balance was, but not individual purchases. So if you’re paying bills on time, you don’t need to worry that eccentric purchases like an epic rubber-duck collection will give lenders pause.

Hard credit inquiry vs. soft inquiry

Checking someone’s credit can be either a hard inquiry or a soft inquiry. Soft inquiries don’t affect your score and are normally only visible to you. Hard inquiries do cause a slight dip in credit score, and they stay on your report for two years.

Soft inquiries happen when you check your own credit, if you get pre-approved for a credit card offer, or sometimes when an employer includes credit checks in the hiring process. When a lender checks your credit as part of the process to approve you for a loan or other financing, this results in a hard inquiry.

Basically, the reason why a credit pull registers as a hard inquiry is because it’s tied to an active application for financing. That is, you’re actively seeking a financing agreement that could factor into your credit and debt balance. Your score takes a temporary hit because if someone were applying for a lot of new debts or lines of credit, that could be a sign that they’re more risky to work with. The dip should only be about 5-10 points, and it should re-stabilize in a few months, so one or two hard inquiries shouldn’t be a problem for your overall score.

What Is Not Included in a Credit Report?

Credit reports collect a lot of important information about your financial health, but they don’t cover everything. Your credit report won’t tell you (or others checking the report) about the following:

# Your income: High income and high credit score don’t always go together. Good credit is about what you do with your money, not how much you have.

# Savings: Saving an emergency fund is an excellent financial move, but not one that will affect your credit score.

# Rent or utilities: Timely payments on your water or heating bills don’t count as credit payments. If your child moves into a first apartment, paying rent when it’s due won’t show up on a credit report, either. Rent or utilities payments that default to collections will negatively impact credit, though, so that’s an important reason to stay on time (besides the obvious benefit of securing services you need in your home!).

What does ‘Not Reported’ mean on a credit report?

Credit reports can be confusing if you’re not used to the abbreviations, symbols, and codes credit bureaus use. On a credit report, “Not Reported” means the creditor didn’t provide information for the time period in question. It’s a gap in the record of information the credit bureau has on file. A “Not Reported” entry won’t negatively impact your credit. It’s a neutral code indicating that the credit bureau didn’t receive information to include.

Why are some debts not on my credit file?

Some debts (or agreements that share some similarities to debt) won’t show up on your credit report. Homeowners who enter a home equity sharing contract with RealtyGO, for example, won’t see that contract on a credit report. RealtyGO’s approach to home financing is not considered a loan, so it isn’t subject to the same set of regulations and isn’t reported to credit bureaus.

In other cases, an actual loan might not appear on a credit report if the lender didn’t submit the information to the credit bureau. Generally, lenders and creditors report debts to the credit bureaus. They aren’t required to do this, though, so it’s possible for a debt not to show up.

Just because you don’t see the debt on a credit report doesn’t mean you don’t owe it, of course! Your debt obligations are between you and the lender, regardless of what your credit report says. Even a debt old enough to “age off” of a credit report after 7 years may still be active if it’s within your state’s statute of limitations. A lender can also report debts to the credit bureaus at any time, even if they haven’t done so before for whatever reason.

Like other lenders, mortgage companies are also not required to report to credit agencies (although normally, they do). Before you apply for a loan, it’s worth checking your credit report to make sure it accurately reflects your current debt, including your mortgage. A mortgage is a major debt. Lenders are likely to find it even if it doesn’t appear on the credit report for some reason, and it will look strange if you haven’t disclosed such a significant part of your financial profile.

Your credit score tells lenders whether you’re a reliable borrower to work with. You can play an active role by checking your credit report to make sure information is accurate and complete, and of course by practicing healthy credit habits to keep your score high.

See why buyers love

RealtyGO Home Loans

“RealtyGO Home Loans was great to work with. My purchase was on a very tight deadline and my own work schedule was extremely busy at the time. RealtyGO Home Loans worked around my schedule and still able to get my deal closed with plenty of time to spare.”

FAQs

Anyone who meets the following conditions can use Redfin to buy a home:

- You must be pre-qualified to borrow the amount needed to buy the property.

- You cannot have a current buyer’s agency contract with another real estate agent.

- You cannot simultaneously have an open offer on another property.

- You must sign the Redfin Buyer’s Agency Agreement.

If you have a RealtyGo account, you can invite others to see and comment on your favorite homes by using the Shared Favorites tool.

As a real estate brokerage, RealtyGo has complete, direct access to Multiple Listing Services (MLSs), the databases that real estate agents use to list properties. This gives us information about homes that many non-brokerage websites don’t have, like whether the home has a water view or is located on a busy street. The RealtyGo estimate algorithm considers hundreds of data points about the market, the neighborhood, and the home itself. When all of this data meets the computing power of our technology, you get the RealtyGo estimate.

Properties labeled as Featured Homes are more likely to sell within two weeks, based on attributes like price, neighborhood, and buyer preferences in the area. You can also see how long a home has been on the market, and how many times it’s been favorited or toured, on the listing page.

Absolutely! A RealtyGo Agent or independent contractor Associate Agent will take you to see your first home tour, and as many as you want after that. Our agents take the time to get to know you and your needs, providing expert advice about the home and the neighborhood—with no pressure to buy.

RealtyGo will ask that you get pre-approved before your third tour with us, and possibly earlier in certain areas and during times of high demand. Getting pre-approved shows sellers that you’re serious about a home purchase. And if you tour a home you really love, being pre-approved makes the offer process faster and easier.

RealtyGO Story